Over the past five years, Japan’s use of nuclear energy has steadily increased following a prolonged shutdown period after the 2011 Fukushima accident. Japan leads the world in nuclear safety upgrades and advanced reactor technology.

Japan’s Nuclear Energy: A Comeback in a Changing Climate Landscape

After more than a decade of hesitation following Fukushima, Japan’s nuclear energy sector is experiencing a slow but determined revival, positioned as a significant element in the country’s strategy for climate change mitigation and energy security. This article examines the status, challenges, and prospects of nuclear energy in Japan in 2025, addressing key questions about its role, costs, technologies, oversight, and waste management.

A Modest but Steady Increase

Over the past five years, Japan’s use of nuclear energy has steadily increased following a prolonged shutdown period after the 2011 Fukushima accident, when nuclear generation dropped to near zero due to sweeping safety upgrades. By 2018, nuclear accounted for just over 6% of electricity generation. By 2024, that figure had risen to approximately 8–9%, with 14 of 54 reactors operating under revised post-Fukushima safety regulations, the highest number since the new standards were implemented. In FY2024, nuclear power generation reached approximately 93.48 TWh, which likely offset more than 60 million metric tons of CO₂ compared to fossil fuel alternatives, based on average emissions factors for coal and natural gas, which still dominate Japan’s thermal power mix. It underscores nuclear’s growing role in Japan’s decarbonization strategy, especially as the country pursues its net-zero by 2050 goal. With 33 reactors in operable condition capable of providing 31,679 MW of electricity, and restarted units achieving a high capacity factor of 80.5%, nuclear energy continues to demonstrate its reliability as a low-carbon baseload source.

Furthermore, government projections and energy plans remain ambitious. The current Strategic Energy Plan (SEP) targets nuclear to contribute 20–22% of electricity by 2030 and around 20% in 2040. However, realistic scenarios project nuclear’s share “medium” up to 12% by 2030 and potentially down to 7–8% by 2040 as reactors age and more plants are decommissioned. Despite government optimism, actual output is likely to be more modest.

What Powers Japan’s Nuclear Fleet?

Japan’s nuclear energy comes almost exclusively from light-water reactors, with two main categories dominating:

- Boiling Water Reactors (BWRs): The most numerous type, including advanced designs (ABWR).

- Pressurized Water Reactors (PWRs):

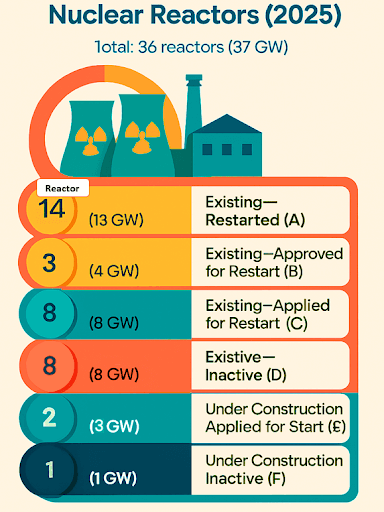

As of early 2025, there are 33 active reactors of the 54 (about 37 GW total capacity), with 14 in commercial operation and another three approved for restart, which represent 61% of the whole (Figure 1). The figure below includes decommissioned or inactive units. Many of these have been upgraded to meet the world’s strictest post-Fukushima safety standards, including earthquake and tsunami resilience. Reactor restarts are progressing, though local opposition and regulatory hurdles remain, particularly at key sites like Kashiwazaki-Kariwa.

Figure 1. Status of Nuclear Power Plants in Japan (March 14, 2025).

Source: Japan Atomic Industrial Forum

Installation Costs and Construction Timeline

Building new nuclear capacity in Japan remains expensive and time-consuming. Upfront investment is high: studies estimate installation costs between 280,000 and 420,000 yen/kW (for past projects), but for new projects, ¥100 billion per unit ($700M–$1B). Global inflation, deregulation, and more rigorous safety requirements have pushed capital costs higher, making new reactors less cost-competitive than in Japan’s earlier era. However, once operational, nuclear plants benefit from low operating costs, competitiveness in stable financing environments, and high utilization rates.

From project planning to operation, a nuclear plant typically takes over a decade to complete (often closer to 15 years) due to environmental reviews, licensing, public hearings, safety design, and construction. This extended timeline is a significant barrier to rapid expansion. Moreover, the past plant meltdown means great public scrutiny, adding to the planning period.

Up-to-Date Technologies and Ongoing Modernization

Japan leads the world in nuclear safety upgrades and advanced reactor technology. All operating reactors must meet the Nuclear Regulation Authority’s (NRA) new standards, far stricter than pre-2011 requirements. Reactors such as ABWR units (the last built before Fukushima) and plans for next-generation designs (Small Modular Reactors, advanced gas-cooled reactors, and even fusion in future decades) show Japan’s commitment to modernization. However, as of 2025, the bulk of operating units remain light water reactors, with new SMRs projected for 2040 or later. There is a relatively strong case for restarting the available reactors since the capacity factor for restarted plants reached 80.5% in 2024, which strengthens the case for nuclear’s reliability.

Oversight and Disposal: Who Watches the Atom?

Today, Japan’s nuclear oversight is led by the Nuclear Regulation Authority (NRA), established in 2012 to enforce rigorous safety and environmental standards. The Atomic Energy Commission (AEC) provides broader policy coordination under the Cabinet. Local governments and communities also play a key role, often exercising strong influence over restart approvals and safety investment.

Compared to the rest of the world, Japan’s approach to nuclear waste is among the most structured, with a focus on closed fuel cycles and minimizing risk. Key processes include:

- Reprocessing and Vitrification: Spent fuel from reactors is reprocessed at facilities like the Rokkasho Reprocessing Plant, transforming high-level waste into solidified glass canisters for long-term storage.

- Low-level waste landfills: Waste of lesser radioactivity is stored at designated sites under NRA oversight.

- Decommissioning of reactors: Old reactors are phased out over 25–40 years, involving fuel removal, component dismantling, and site cleanup, sometimes stretching into the mid-21st century.

- Fukushima cleanup: The world’s most high-profile radioactive cleanup continues, with ongoing wastewater management and robotic removal of highly radioactive debris. Controlled releases of treated water, IAEA/NRA monitoring, and creative measures (such as using slightly radioactive soil for public gardens) are all part of efforts to reassure the public and showcase safety progress.

Progress, Caution, and Public Trust

Japan’s nuclear sector is slowly regaining trust and utility. The share of nuclear has grown in the national energy mix, supported by government plans and climate imperatives, but expansion faces technical, regulatory, and social challenges. Advanced reactors, stricter oversight, and careful waste management are bringing Japan back to the global nuclear stage, but with an emphasis on caution and transparency.

Nonetheless, as Japan pursues net-zero ambitions, nuclear power will remain a key, carefully monitored pillar in the country’s energy portfolio, delivering stable, low-carbon electricity while balancing the lessons of its recent past.

Global Context and Climate Framing Strategies

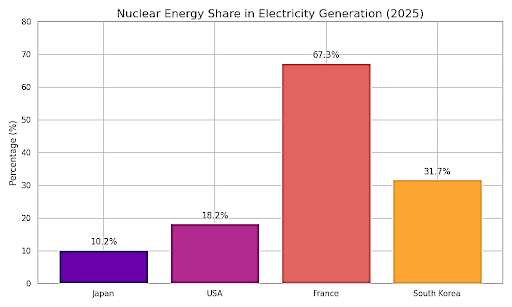

Japan’s cautious nuclear revival is part of a broader global trend, as several major economies re-evaluate nuclear energy’s role in achieving climate goals. Countries like France, South Korea, and the United States are actively investing in nuclear technologies to reduce carbon emissions and enhance energy security (Figure 2). France continues to rely on nuclear for the bulk of its electricity, over two-thirds, while South Korea is expanding its fleet under its Green Growth policy, aiming to stabilize its energy mix and meet climate targets. The U.S., with the world’s largest reactor fleet, is investing in Small Modular Reactors (SMRs) and extending the life of existing plants to support its decarbonization strategy.

Japan’s approach stands out for its emphasis on public trust, technological modernization, and post-Fukushima safety reforms. While its nuclear share remains modest compared to these peers, Japan’s restart strategy reflects a deliberate balance between climate imperatives and social accountability.

Figure 2. Comparison of Some Industrial Countries’ Utilization of Nuclear Power for Electrical Energy Generation.

The comparison above highlights Japan’s position within the global nuclear landscape. It is seen that, while its share is lower, its trajectory is upward, driven by climate commitments, energy security concerns, and a strong regulatory framework.

This Post was submitted by Climate Scorecard Japan Country Manager, Delmaria Richards.

Learn More Resources:

- Zissler, R. (2025, March 21). Japan’s FY 2030 & FY 2040 Nuclear Power Targets Are Probably Out of Reach. Renewable Energy Institute. https://www.renewable-ei.org/en/activities/column/REupdate/20250321.php

- Renewable Energy Institute. (2025). Current Status of Nuclear Power Plants in Japan. https://www.jaif.or.jp/cms_admin/wp-content/uploads/2025/03/jp-npps-operation20250314_en.pdf

- ISHII, N. (2025, April 21). Japan’s Restarted Nuclear Plants Achieve 80.5% Capacity Factor in FY24. Japan Atomic Industrial Forum. https://www.jaif.or.jp/en/news/7498

- Statista. (2025). Nuclear energy in Japan – statistics & facts. https://www.statista.com/topics/7551/nuclear-energy-in-japan/

- World Nuclear Association. (2025, August 5). Nuclear Power in Japan https://world-nuclear.org/information-library/country-profiles/countries-g-n/japan-nuclear-power

- Koyama, K. 2025 Global and Japanese Energy Outlook. https://eneken.ieej.or.jp/data/12263.pdf

- Yanagisawa, A., et al. Economic and energy outlook of Japan for FY2025. The Institute of Energy Economics, Japan.

https://eneken.ieej.or.jp/data/12320.pdf

- Lee, C. Nuclear comeback? Japan’s plans to restart reactors hit resistance over radioactive waste.

https://www.climatechangenews.com/2025/07/06/nuclear-comeback-

japans-plans-to-restart-reactors-hit-resistance-over-radioactive-waste/

Summary – Not to be included in the article.

| Question | Answer Summary (2025 specifics) |

|---|---|

| Update on nuclear energy use | Japan’s nuclear output has increased steadily since 2018, with 14 reactors operating and nuclear generation reaching 93.48 TWh in FY2024, up from near-zero after Fukushima. |

| Increased or decreased over the last 5 years? | Increased: From ~6% of power in 2018 up to 8–9% in 2024; 14 of 33 operable reactors restarted under demanding new standards, marking the highest post-Fukushima restart rate. |

| Percent of energy from nuclear | 8–9% of electricity generation in FY2024; the government targets 20–22% by 2030, but realistic projections place it at 12% in 2030. |

| Primary sources of nuclear power | Light-water reactors, primarily Boiling Water Reactors (BWR), including advanced ABWRs, and Pressurized Water Reactors (PWR). |

| Cost to install and operate | High upfront cost: ¥280,000–¥420,000/kW historically (new: ¥100+ billion/unit), but once running, plants enjoy high capacity (80.5%) and stable operating costs. |

| Use of updated reactors | Yes, all operating units meet the Nuclear Regulation Authority’s (NRA) strict post-2011 standards. Advanced ABWR and plans for SMRs/fusion, most units are upgraded LWRs. |

| Installation time | Over a decade (often 15 years) from initial planning to grid connection; safety reviews, licensing, and public consultation add to the timeline. |

| Monitoring authority | Nuclear Regulation Authority (NRA) (est. 2012) leads safety; Atomic Energy Commission (AEC) coordinates national policy. Local governments play a key approval role. |

| Nuclear waste management | Closed fuel cycle with reprocessing and vitrification at Rokkasho Plant; low-level landfills; 25–40 year decommissioning for old reactors; robust oversight for Fukushima. |